Home Loan Eligibility in India: How Much Loan Can You Get in 2025?

Buying a home is a big financial step, and knowing how much loan you can get based on your salary is crucial. Lenders assess various factors to determine your home loan eligibility, with your income being a primary consideration.

Aditya Pratap Singh • 7 Feb 2025

5 min read

Let's delve into how your salary influences the loan amount you can obtain in 2025.

Factors That Determine Your Home Loan Eligibility

1. Your Monthly Salary (Net Income)

Your home loan amount largely depends on how much you earn each month. Lenders usually allow EMIs (Equated Monthly Installments) up to 40-50% of your net monthly income. This means if your take-home salary is ₹50,000, your EMI should ideally not exceed ₹20,000-₹25,000 per month.

Example: If you earn ₹50,000 per month, your EMI should be around ₹25,000 max. Based on a 7.5% interest rate for a 20-year tenure, you can get a loan of ₹30-35 lakh.

2. Existing Financial Obligations

Your current financial commitments impact how much loan you can get. If you already have a car loan, personal loan, or credit card EMIs, banks will subtract those EMIs from your income before calculating your eligibility.

Example: Scenario 1 (No Existing Loans): If you earn ₹1 lakh per month and have no loans, you may get a home loan of ₹75-85 lakh.

Scenario 2 (Existing EMIs): If you have a ₹20,000 EMI for a car loan, your loan eligibility will be lower, around ₹55-65 lakh.

Tip: Pay off smaller loans before applying for a home loan to increase your loan eligibility.

3. Loan Tenure (Longer Tenure = Higher Loan Amount)

The number of years you choose to repay the loan affects the amount you are eligible for. A longer tenure means lower EMIs, but you’ll end up paying more interest overall.

Example: If you earn ₹60,000/month: 15-year tenure: You may get a ₹40-45 lakh loan (higher EMI). 30-year tenure: You may get a ₹55-60 lakh loan (lower EMI).

4. Credit Score (Higher Score = Better Loan Eligibility)

A CIBIL score above 750 increases your chances of getting a higher loan amount at a lower interest rate. If your score is low, banks may offer a smaller loan or charge a higher interest rate.

Tip: Before applying for a home loan, check your credit score on the Saral Funding website and improve it if needed by paying bills on time and reducing debt.

5. Age & Job Stability

Lenders prefer borrowers with stable jobs and regular income. Younger applicants can opt for longer tenures (up to 30 years), which increases eligibility. Older applicants may have to choose shorter tenures, limiting the loan amount.

Example: A 25-year-old with ₹50,000/month salary can get a ₹35-40 lakh loan for 25 years. A 45-year-old with the same salary may get only ₹20-25 lakh due to a shorter loan tenure.

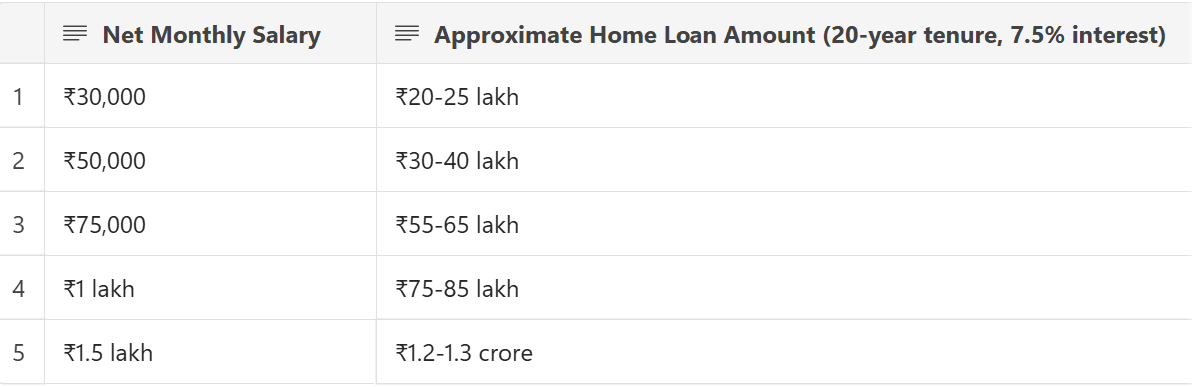

Home Loan Eligibility Based on Salary (2025 Estimates)

Here’s an estimate of how much home loan you can get based on your monthly net salary in India:

Use the Home Loan Eligibility Calculator on Saral Funding’s website to get an exact estimate.

How to Increase Your Home Loan Eligibility?

1. Opt for a Longer Tenure: A 30-year loan tenure reduces your EMI, increasing the loan amount you can get.

2. Apply with a Co-Applicant: If your spouse or parent has a steady income, applying together can boost your eligibility.

3. Reduce Your Existing Debt: Clear credit card dues and personal loans before applying.

4. Improve Your Credit Score: A 750+ CIBIL score increases your chances of getting a better loan amount.

Conclusion: Plan Smart with Saral Funding

Understanding your home loan eligibility helps you plan better and choose the right property within your budget. Saral Funding helps home buyers find the best home loan options with low interest rates and easy approvals.

Want to check how much home loan you qualify for? Visit Visit here and use our Home Loan Calculator today!